Investments

We have three priorities in investing your donations for charity: safety, ethics and high interest.

Safety

Managing investments in a safe way is our highest priority. To do this, we take several measures:

- We do not invest in businesses ourselves, all we do is choose the best investment funds

- To choose the investment funds, we use the investment fund scoring methodology of our bank ABN AMRO

Ethical, sustainable and social

All investments at Give For Good are done in accordance with ‘responsible’ investment values. Responsible investing means that ethical, sustainable and social standards are taken into account in the investments.

High interest

Finally, we make it a priority to generate a high interest every year for the charities.

ESG + SRI: Responsible investing in practise

Responsible investing

Investment funds

Donations are invested in six investment funds to achieve good diversification. These funds were selected because they all have the highest ESG-score in their class in the ABN AMRO’s scoring methodology for investment funds, they have a low annual cost, and they have adequate liquidity (meaning they have a good size, which makes them trustworthier and more easily tradable). See here for the ABN’s methodology for calculating the ESG-scores (the scores are provided by Sustainalytics).

Four of the funds are global-level SRI funds with stocks from developed countries:

- Amundi Index MSCI World SRI ETF

- BNP Easy MSCI World SRI Paris-Aligned ETF

- iShares MSCI World SRI ETF

- UBS ETF MSCI World SRI ETF

- UBS MSCI World Small Cap Socially Responsible ETF

- UBS MSCI Emerging Markets SRI Low Carbon Select ETF

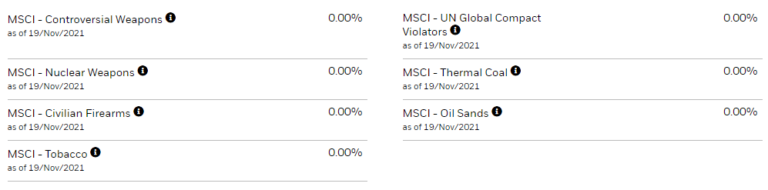

- They exclude investments in companies involved in industries such as Weapons, Tobacco, Gambling, Oil and Coal.

- They contain additional measures (extra selections or tilts) to select businesses that score the best on ESG/SRI indicators.

- They invest in a large amount of businesses, thus providing excellent diversification. All stock ETFs are so-called ‘index-funds’.

- They all have very low annual costs.

- They are all adequately liquid.

Here below you is an example of how much the iShares MSCI World SRI ETF invests in several specific sectors such as weapons, tobacco, oil and coal. Similar overviews are available in the investment details of each of the ETFs we invest in.